The value of global mergers and acquisitions in 2018 totaled $3.53 trillion—the third-highest deal value on record, according to a new Mergermarket report. But the total number of deals marked the first global decline since 2010.

In the U.S. alone, M&A deal value reached $1.5 trillion, a figure the report calls the second-highest U.S. total to date (2015 is still the leader, with just under $1.8 trillion) as well as an increase from 2017′s $1.3 trillion. Although the number of U.S. deals dipped slightly from the all-time high of 5,800 in 2017 to 5,718 in 2018, the past year still stands as the second-best on record by that measure.

The U.S. mega-deals that characterized 2018 include Cigna’s $67 billion acquisition of Express Scripts, T-Mobile’s $60.8 billion acquisition of Sprint Corp., Energy Transfer Equity’s $59.6 billion acquisition of Energy Transfer Partners, IBM’s $32.6 billion acquisition of Red Hat, and Harris Corp.’s $184 billion acquisition of L3 Technologies (which the report calls the biggest defense-sector deal on record). As large as these U.S. deals are, they fall short of Japanese firm Takeda Pharmaceutical Co.’s $79.7 billion acquisition of Ireland’s Shire Plc.

The figures for U.S. M&A come against a backdrop of rising global and economic tensions and, in particular, falling trade between the U.S. and China, the report notes. Trade between the two powers dropped 94.6 percent to just under $3 billion in 2018, and U.S.-China M&A has faltered. “In fact, the largest Chinese bid for a U.S. company in 2018 did not even break the billion-dollar mark—Bison Capital’s $450 million bid for U.S. biopharmaceutical firm Xynomic Pharmaceuticals, whose completion is still pending,” the report states.

Driving Factors

Nevertheless, U.S. M&A by any measure had a historic year.

“Two driving factors jump out at me, and they complement each other: It’s been 10 years since the financial crisis, and we have a strong economy with low inflation, low unemployment and historically low interest rates,” said Elizabeth Lim, who conducted the research for the Americas section of the report.

Transactional law firms, and U.S. law firms, in particular, are the direct beneficiaries of these trends, although the intensive competition has unseated some firms from their positions in last year’s league tables.

“What’s interesting about all these deals is that they’re strategic deals. Old-line companies are looking to survive and move into the future, and in order to do that, they’re competing for market share, technological advantage, IP, and human capital,” Lim said. “Corporations are consolidating and looking to do mega-deals, and they’re looking for a law firm that is expert and can get them through the regulatory hurdles in multiple jurisdictions.”

Indeed, corporations are using discernment when it comes to choosing outside M&A counsel, and the report’s league tables reveal a shake-up of the market positions of law firms advising on M&A.

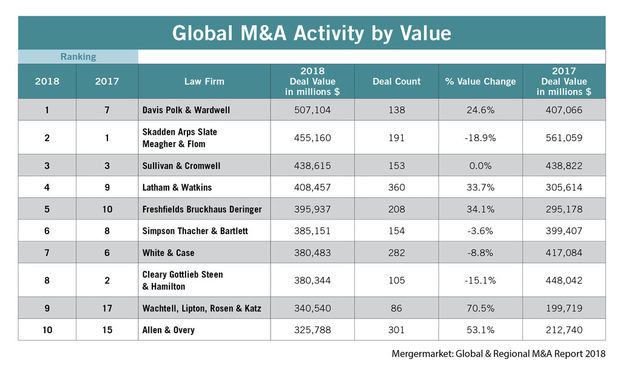

Davis Polk & Wardwell, which came in at No. 7 in 2017′s league tables for global deal value, rose to the No. 1 spot in that category for 2018, with a total of $507.1 billion in combined deal value. Davis Polk pushed Skadden, Arps, Slate, Meagher & Flom into the No. 2 spot, with a total of $455.2 billion worth of deals completed in 2018. Sullivan & Cromwell managed to hold onto its third-place global ranking, doing M&A with a total $438.6 billion value in 2018. Kirkland & Ellis fell from the fourth spot all the way to No. 13, doing $295.6 billion worth of M&A deals in 2018. However, Kirkland’s number of deals—568—exceeds the numbers for the top three players Davis Polk (138), Skadden (191) and Sullivan & Cromwell (153).

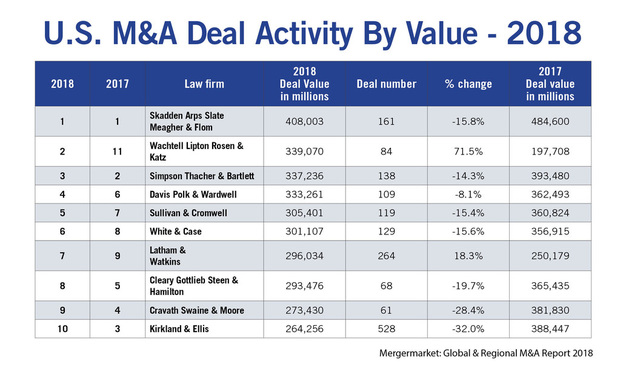

In U.S. M&A, Skadden retained its No. 1 ranking, with a combined deal value of $408 billion.But Wachtell, Lipton, Rosen & Katz rose dramatically in the rankings, from the 11th to the second spot, doing $339 billion worth of deals, and pushing Simpson Thacher & Bartlett into the third spot with a total of $337 billion.

Kirkland & Ellis’ performance in U.S. M&A mirrors to some extent its global M&A totals. Although the law firm fell from position three to position 10 in deal value, doing a total of $264 billion in U.S. M&A, the firm is in the No. 1 spot for deal count, having advised on 528 deals, a figure that vastly exceeds the numbers for runners-up Jones Day (326 deals), DLA Piper (296 deals) and Goodwin Procter (290 deals).

2019 and Beyond

This year is already off to a busy start on the M&A front, with one of the largest biopharma mergers on record, Bristol-Myers’ $74 billion acquisition of Celgene Corp., announced in the first week of the year.

While Lim is mostly optimistic that the forces and factors making 2018 a record year for M&A will continue in 2019 and beyond, her optimism is guarded.

“We’re going to see the U.K. leave the E.U. in March. We don’t know what the deal, assuming there is a deal, will look like. And with Democrats in charge of the House, we will have to see how their relations with the president and Senate play out,” Lim said.